AroFlo offers a range of invoicing options. When invoicing, you can create different invoice types:

- Final invoices for any balance due at the end of a task.

- Part Invoices for deposits or progress claims during a task or quote

- Sales Invoices for charges that are not related to a task (such as over-the-counter sales).

Click the expand below to have us walk you through picking the most appropriate invoice type or click the invoice types in the table of contents to be taken straight to their relevant instructions.

Help me decide which kind of invoice to make

Are you invoicing a job or quote?

Create a Final Invoice

|

A final invoice is created from a completed task. Once the status of a task is 'Completed', the Create Final Invoice button appears. To create a final invoice:

The Invoice Worksheet will then appear. Interested in learning through an interactive course in the AroFlo Academy? |

|

|

Create a Part Invoice

|

A part invoice can be created at the start of a job, during the course of a job, or at the quote stage, to invoice the client for part of the work undertaken. Automated Deposits You can also use our Automated Deposit Invoicing feature to automatically generate a deposit invoice upon your client's acceptance of the quote, saving you from manually creating one. You can also automate task status and substatus both once the quote has been marked as accepted and once a payment has been recorded on the deposit invoice. To manually create a part invoice:

The Invoice Worksheet will then appear. Interested in learning through an interactive course in the AroFlo Academy? |

|

|

Create a Sales Invoice

|

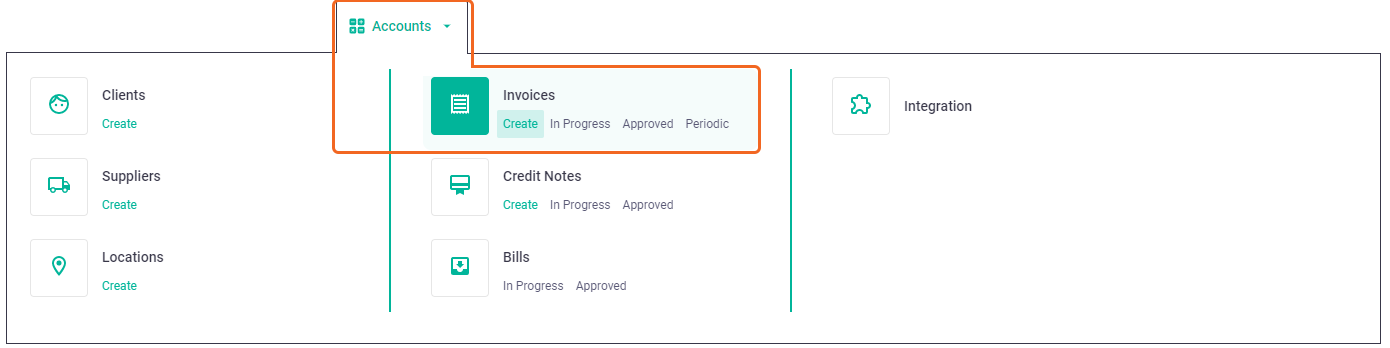

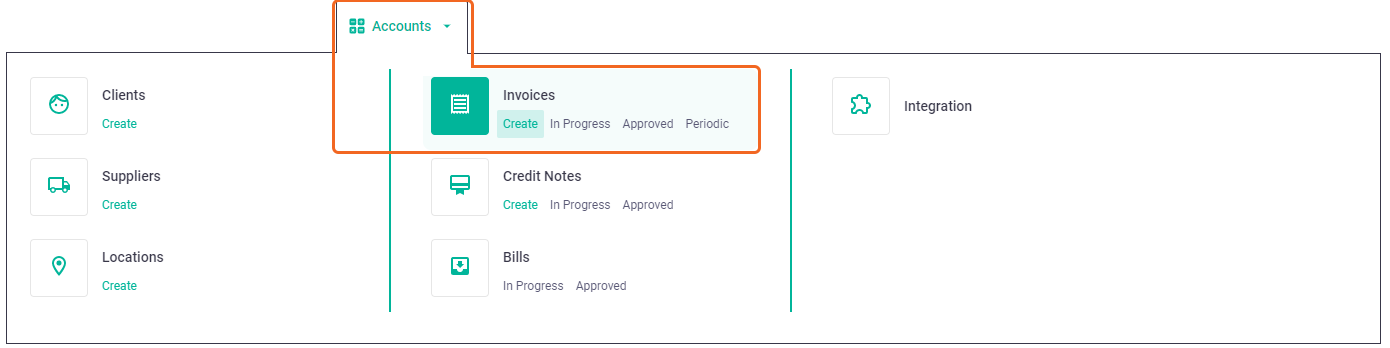

Sales invoices are used for charging costs that are not directly related to a Task or Project, such as over-the-counter sales of items. To create a sales invoice, go to Create > Invoice. Alternatively via Accounts > Invoicing > Create Sales Invoice The Invoice Worksheet will then appear. |

|

|

Once you have created an invoice, you can complete the Invoice Worksheet.