Tax calculations

AroFlo calculates tax for each line item (unit prices allow up to 4 decimal places), then sums the tax totals of each line item to calculate the total tax value and rounds to 2 decimal places.

Accounting Integrations - Rounding Account

Your accounting package may use a slightly different calculation method which can result in a rounding discrepancy when posting data from AroFlo.

It is best practice to set up a rounding account within your accounting package specifically for handling rounding discrepancies. All of our accounting integrations support rounding account codes.

For more information about rounding accounts, see Accounting Tax Rounding.

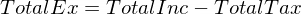

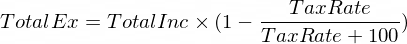

Tax on your Invoice

|

Your accounting package may use a calculation method which can result in a rounding discrepancy when posting data from AroFlo.

If the GST amount on your invoice is not exactly one-eleventh of the total price, you can adjust your layout to include a statement such as 'Total price includes GST'.

For more information, refer to Example 2 in the ATO documentation Issuing Tax Invoices. |

|

|

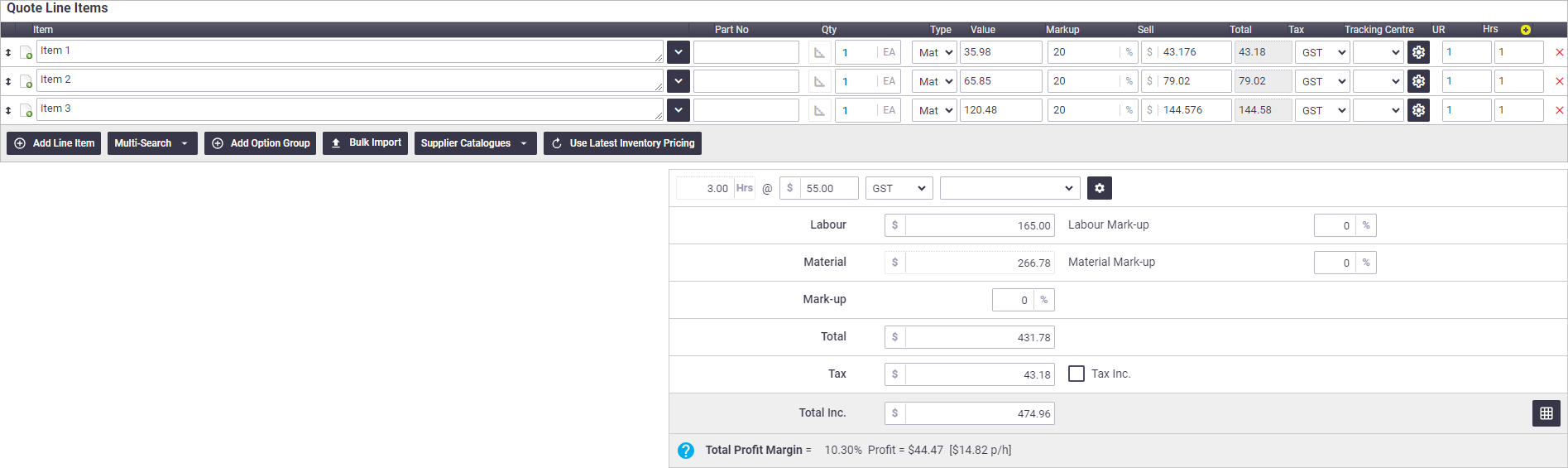

Example of tax on a simple quote

|

Item 1: Item 2: Item 3: Labour: Sub totals:

Overall total (inc. tax) = $474.96 |

|

|

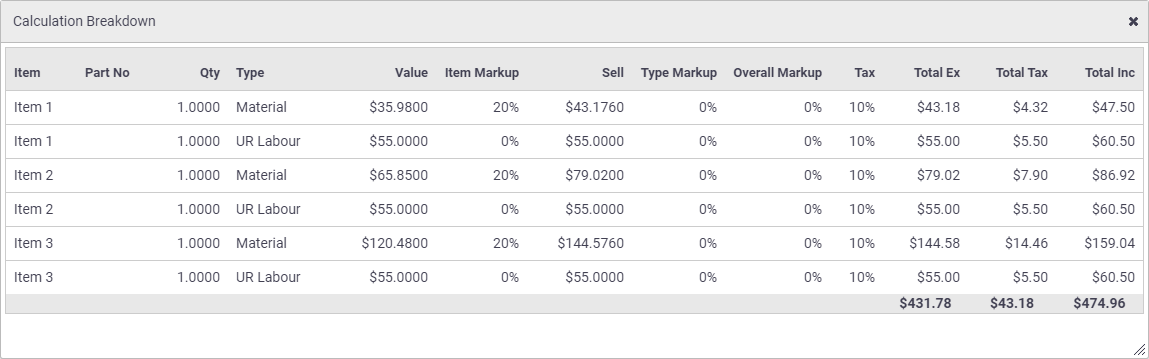

The calculation breakdown  allows you to clearly see the cost value, markups, tax, and totals (ex. / inc. tax) for each item:

allows you to clearly see the cost value, markups, tax, and totals (ex. / inc. tax) for each item:

Standard calculations

The following calculations are used for calculating line item values and totals in quotes and invoices:

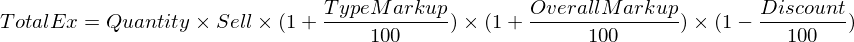

Total excluding tax

Show the equation

If using a type markup (applies to LAB or MAT type items), overall markup or discounts, the total excluding tax value is calculated and only then rounded to 2 decimal places:

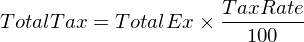

Total tax

Show the equation

Total tax is calculated using the Total excluding tax (which may already be rounded to 2 decimal places). The Total tax value is then rounded to 2 decimal places.

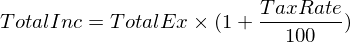

Total Inc Tax

Show the equation

Total Inc is calculated using the Total excluding tax (which may already be rounded to 2 decimal places). The Total Inc value is then rounded to 2 decimal places.

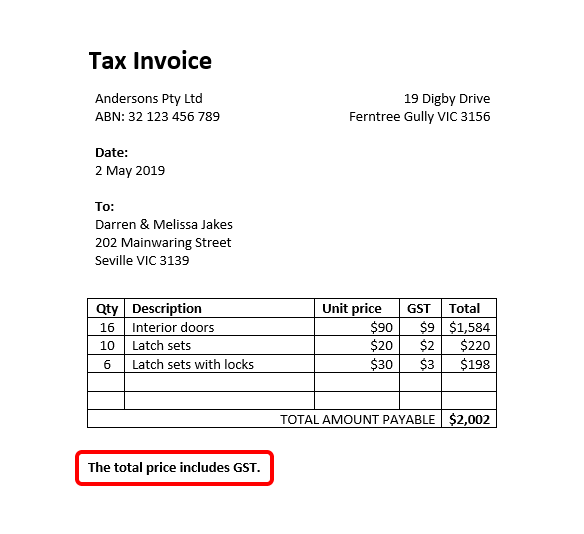

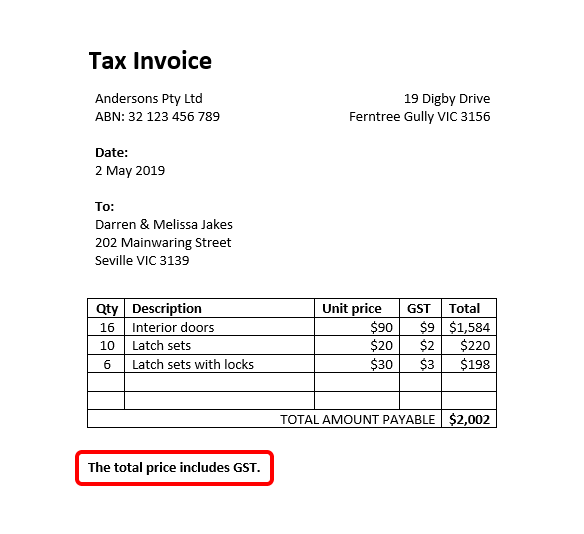

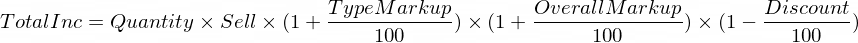

New Tax Inc calculation

Show the equation

These calculations are used when the cost / sell prices already include tax.

The total ex can be written in two ways: